property taxes north las vegas nevada

Determine the assessed value by multiplying the taxable value by the assessment ratio. CALCULATING LAS VEGAS PROPERTY TAXES.

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Las Vegas NV 89106.

. Property Tax Solutions in North Las Vegas NV. Search by one of the following. 500 S Grand Central Pkwy.

YEARS IN BUSINESS 702 639-6251. We are open 730 am. Parcel TypeBook Page.

You can expect to see property taxes calculated at about 5 to 75 of the homes purchase price. To ensure timely and accurate posting please write your parcel number s on the check and include your payment coupon s. Median Property Taxes No Mortgage 1233.

Visit Our Website Today. Treasurer - Real Property Taxes. - 530 pm Monday through Thursday except for holidays.

800 326-6868 for Telecommunications Device for the Deaf TDD access. Tax Rate 32782 per hundred dollars. Office of the County Treasurer.

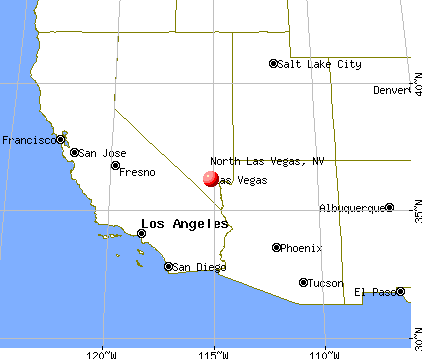

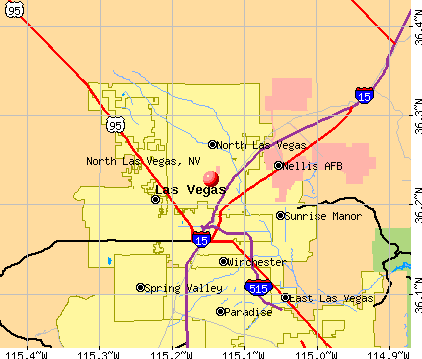

Home Government Assessor Real Property Property Search Real Property Records. North Las Vegas stretches across the northern rim of the Las Vegas Valley and is home to more than 275000 residents. Property taxes in Nevada pay for local services such as roads schools and police.

Make Real Property Tax Payments. Facebook Twitter Instagram Youtube NextDoor. 5261 Golden Melody Ln North Las Vegas NV 89081 479900 MLS 2423503 SPACIOUS 5 BEDROOM 3 BATHROOM HOME WITH A LOFT.

Establishing tax levies evaluating property worth and then collecting the tax. North Las Vegas Property Tax Payments Annual Median Property Taxes. ONE BEDROOM DOWNSTAIRS WITH 3.

Grand Central Pkwy Las Vegas NV 89155. What is the Property Tax Rate for Las Vegas Nevada. Every municipality then receives the assessed amount it levied.

500 S Grand Central Pkwy 1st Floor. Make Personal Property Tax Payments. Doing Business with Clark County.

We have included an interactive CitiesCounty map for Las Vegas Henderson North Las Vegas Boulder City Mesquite and the unincorporated areas of Clark County in our web page. 200000 taxable value x 35 assessment ratio 70000 assessed value. Taxing authorities include Las Vegas county.

Office of the. To determine the assessed value multiply the taxable value of the home. The states average effective property tax rate is just 053.

NORTH LAS VEGAS CITY 911 RENEWABLE ENERGY. You may pay in person at 500 S Grand Central Pkwy Las Vegas NV 89106 1st floor behind the security desk. However the property tax rates in Nevada are some of the lowest in the US.

Checks for real property tax payments should be made payable to Clark County Treasurer. 5 beds 3 baths 2662 sq. Tax District 200.

Overall there are three stages to real property taxation. NORTH LAS VEGAS CITY 911. 2250 Las Vegas Boulevard NorthSuite 200North Las Vegas NV 89030Phone 702 633 1213Fax 702 399 1716 Manager Lorena Candelario SR WA Senior Office Assistant Tracee Hales Real Property Services assists City departments in all facets of real estate transactions providing strategic advice and purchasing property rights for City projects ranging from street rights.

Get Access To North Las Vegas Property Records. Las Vegas NV 89106. Las Vegas NV 89155-1220.

North Las Vegas NV 89030. For fiscal year 2022-23 the property tax cap rate for primary residences is 3 and other properties investment commercial etc is 8. In order to download the Area Map you must have the Adobe Acrobat Reader installed on your computer.

To calculate the tax on a new home that does not qualify for the tax abatement lets assume you have a Home in Las Vegas with a taxable value of 200000 located in the as Vegas with a tax rate of 350 per hundred dollars of assessed value. Clark County officials said they say a significant. Office of the County Treasurer.

To collect the property tax in a fair and consistent manner North Las Vegas Nevada tax authorities need to have an objective formula for deciding the value of land under its. 2235 E Cheyenne Ave Ste 180. The property may be redeemed by payment of taxes and accruing taxes penalties and cost together with interest on the taxes at the rate of 10 percent per annum from the original date due until paid.

702 455-4323 Fax 702 455-5969. Median Property Taxes Mortgage 1422. Ad Avoid Expensive Mistakes By Searching Property Records Online Before You Buy.

Las Vegas NV 89106. Home Government Assessor Real Property Tax District Maps. Property owners have two years from the date of the certificate to redeem the property by paying the property taxes and all associated costs in full.

Relay Nevada accessible services are available by. Find My Commission District. If you receive a tax bill with the incorrect property tax cap percentage and youve submitted a correction form the Treasurers Office will send you a revised bill once the updated tax cap information has been processed.

Las Vegas NV 89155-1220. Usually North Las Vegas Nevada property taxes are decided as a percentage of the propertys value. Once every 5 years your home is required to be re-appraised by County Assessors.

500 S Grand Central Pkwy 1st Floor. Tax rates differentiate widely but they typically run from less than 1 up to about 5. In Nevada the market value of your property determines property tax amounts.

Name A - Z Sponsored Links. Apply for a Business License. CLARK COUNTY TAX RATES A tax district is an area defined within a county for taxing purposes.

Compared to the 107 national average that rate is quite low.

Pros And Cons Of Living In North Las Vegas Nv Retirebetternow Com

North Las Vegas Nv Luxury Homes For Sale 1 436 Homes Zillow

North Las Vegas Nevada Nv Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Moving To Las Vegas Here Are 15 Things To Know Extra Space Storage

Clark County Property Tax Hike Confusion And Frustration Persist Las Vegas Review Journal

2700 E Bonanza Rd Las Vegas Nv 89101 Loopnet

Clark County Property Taxes Misinformation Addressed By Assessor Las Vegas Review Journal

Clark County Property Taxes Misinformation Addressed By Assessor Las Vegas Review Journal

Clark County Property Tax Hike Confusion And Frustration Persist Las Vegas Review Journal

Initial Real Property Tax Bills Mailed To Clark County Residents Las Vegas Review Journal

North Las Vegas Nevada Nv Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Lake Mead Pecos North Las Vegas Nv 89030 Loopnet

Living In Las Vegas Nv Pros And Cons Of Moving To Las Vegas 2022 Retirebetternow Com

Las Vegas Vs Clark County There Are Differences Between Living In City Limits And Unincorporated County Land Las Vegas Sun Newspaper